This is how you may generate your Business Plan Financial Analysis. I know so many of you out there are worried about; how you write a financial analysis for a business plan. Or, how do you write a business plan financial model? And, you are faced with the challenge of how do you prepare a cash flow statement for a business plan. For your information, it’s not only financial cash flow you need to prepare.

You will also prepare the income statement and the business financial position for a particular time called Balance Sheet. As a matter of fact, this is a key aspect of your business plan. A business plan without financial analysis is a mere narrative and aspirations. Read more about This is how you may generate your Business Plan Financial Analysis

Business Plan Financial Analysis Templates:

Table of Contents

So, this is how you may generate your Business Plan Financial Analysis. They are relevant for start-up businesses and for business expansion plans. These templates are available from us on request for a minimal cost. In fact, if you are doing it by yourself, start with a sales forecast. For this, set up a spreadsheet projecting your sales over the period of projection. Do also create an expense budget. Then generate the income projection and with that develop a cash-flow statement. Now, deal with assets and liabilities. You may also need a break-even analysis.

In any case, are you concerned about the future of your business? Then, an indispensable strategy is to set up your financial planning to be more secure in the company’s start-up operations and growth. See how to assemble yours!

Entrepreneur’s Need for Financial Analysis:

With the many roles you play as an entrepreneur, it’s often difficult to find time to sit and focus on the company’s financial plans. However, learning how to do or implement business financial planning is crucial for the future growth and success of your business. Now, rad more about This is how you may generate your Business Plan Financial Analysis

The development and use of a financial plan allow you to see the areas where resources are most needed for business growth. Such areas as marketing, expansion or product development. Without this vision, business decisions become more risky and your business may end up missing out on great opportunities.

Steps: This is how you may generate your Business Plan Financial Analysis

To start with, personal and business goals must be separate. The same goes for personal and business finances. However, both are equally important and will affect each other. When running a business, it can be very easy to neglect personal goals. That is why it is essential to define separate financial plans for the business and personal side of life.

As a matter of fact, continue reading the post to better understand how to find this solution in your company and leverage the market. So, what is corporate financial planning? And, how is Business Financial Plan Being Done? Continue reading This is how you may generate your Business Plan Financial Analysis

Current Cost & Revenue based on Scenarios:

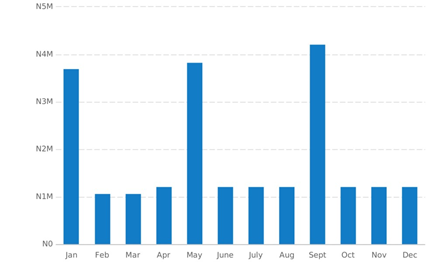

Now, understand that financial planning analyzes current costs and revenues and future scenarios to help determine the best action plan. So, it touches on all aspects of your planning. It includes fixed assets and current assets. So, there must be a forecast for raw material inputs, payroll estimations, workforce training, marketing, inventory, and research and development. Then comes your revenue estimations. Remember that here the important variables are the quantity of stock for sale and unit prices. Read more about This is how you may generate your Business Plan Financial Analysis

As a matter of fact, this comprehensive strategy demonstrates a company’s commitment to sound business practices. It defines the ability to meet financial obligations and spend wisely. This will certainly encourage outside investors and increase the likelihood of long-term success.

Simple Definition:

In fact, financial planning is simply the process of allocating funds and determining how a business will achieve the different goals and objectives described by the operators.

Start-up Without Financial Model Support:

As a matter of fact, this process is almost as important as creating a business. So, it’s a necessity for any company belonging to any sector. However, experience has shown that not all organizations adopt financial planning, especially small businesses with limited budgets to invest. But that is not good. Plan your business no matter the size of your investment. Get our 5-five page financial forecast for your business at a minimal cost by contacting us.

At any rate, financial planning is important for the overall functioning of your start-up or expanding business. Therefore, it is almost impossible for an organization to function and be financially stable without relying on some type of financial management process. In fact, we can see that not all companies are able to achieve success and one reason for this may be the lack of financial planning and analysis. We put up this article because we see an urgent need for businesses to reap the benefits of this financial processing. This is how you may generate your Business Plan Financial Analysis

You may be asking, what is it for?

Here are some reasons why business start-up or expansion financial planning is good for your business:

Short-Term Scenarios:

Financial Planning Leads to Success. This is because it leads to judicious use of funds. In fact, a smart and powerful benefit of planning a financial program is to use all the funds you have carefully. This is how you may generate your Business Plan Financial Analysis

Planning in advance all the taxes and expenses (liabilities) that an organization is liable to pay. Covered are general and miscellaneous expenses, salaries, etc. This will provide a good idea of how to manage its funds.

Furthermore, a specific management system will provide all possible solutions to plan your finances well. Prioritizing important areas and sections of your company will help you identify where to invest urgently and which sections of your company can be invested in later.

Long-term vision

With sufficient financial planning, companies can have a clearer long-term view of their allocation of funds. Analyzing and deploying funds for various segments/departments in your company can have a positive effect in the long run.

In fact, the financial reports generated provide deep insights into the workings of a company. Senior management and business owners take these financial reports as a guide to predicting the organization in the future. This requires an idea-based decision. Read more about This is how you may generate your Business Plan Financial Analysis

Marketing strategy

Furthermore, business marketing strategies provide well-structured tasks for the business. You have to start with the techniques, execution, and implementation of the plans. Planning your finances well will help your company identify the important strategies that need to be implemented. In fact, these actions you plan for your business must be measurable and be able to generate more business.

To measure liabilities and assets – This is how you may generate your Business Plan Financial Analysis

In addition, who monitors a company’s assets and liabilities? What is the proportion of liabilities and assets for your organization? For the stability of a business, the finance team regularly monitors the assets and liabilities of a business.

This gives you an idea of all the necessary improvements to your business and how to increase your assets and decrease your liabilities. This provides an overview of which areas of the organization require investment in the past.

Measure profit and loss

Reports compiled by your organization’s finance team generally help the organization assess the organization’s profits and losses. In addition, this helps the company to assess which strategy has worked well for your company. This shows the net profit that a company was able to achieve and what was the main reason for that. This is how you may generate your Business Plan Financial Analysis

In fact, there is no point in making money until and unless you are able to make a profit for your business. For all small business owners, we recommend that you consider financial planning to maintain your stability. You can contact us for your business financial forecast. With the relevant business variables, your financial forecast for planning and managing your business plan will be ready in 3-days.

This is how you may generate your Business Plan Financial Analysis

Importantly, experience has shown that for every 42% of small and medium-sized entrepreneurs who start their businesses without a good business plan in place end up going bankrupt within three years. In fact, this is because they do not take into account all that has already been mentioned. Don’t be one more to have this negative experience. Make a good financial schedule for your business today. We can help you out if you contact us.

When should it be done? How to do it?

Financial planning is usually carried out following a process with the following steps:

- sales forecast;

- projection of assets needed to support sales;

- projection of funds generated or to be generated within the organization;

- And, projection of external funds that will be needed;

- identifying the means to raise funds;

- evaluation of the effect of plans on financial indices

- This is how you may generate your Business Plan Financial Analysis

As a matter of fact, doing well here means you must be up and doing watching your business plan forecasts. In this respect, financial planning must be done throughout the year. So, it requires the support of accurate financial reporting and analysis. Not only does it need to be carried out constantly, but the results of these plans also need to be monitored. If they are not working, new plans need to be developed or the old ones need to be modified.

Your Team or a Consultant: This is how you may generate your Business Plan Financial Analysis

The larger the business, the larger the team that works on financial planning and the greater the skill required. In this way, it starts before the start of an enterprise and continues throughout its life. It is a vital activity for all businesses.

Thus we can understand that it is more efficient to organize an organization in the fiscal accounts with monitoring of metrics so that your company is not part of many that go down year. So, get a consultant; get Complete Full Marks Consultants Ltd to help you out at a minimal cost.

How to do financial planning?

Furthermore, to create a solid financial plan, you will need to analyze the main components of your business. Make assumptions about cash flow. That is, how much money you are getting and paying. What are your biggest costs and where are they likely to increase spending most in the near future? Where can you cut costs? How will competition likely affect your business? Read more about This is how you may generate your Business Plan Financial Analysis

Furthermore, you will also look at possible changes in your workforce and external circumstances, such as fluctuations in the economy – a cycle of recession or growth – and inflation. This can have dramatic effects on business growth.

This is how you may generate your Business Plan Financial Analysis

In addition, you can also consider how your company compares to similar companies in your industry. Their stories, especially if they are a little further in terms of experience and success, can inform your decisions. How do they tend to invest their earnings? What are your priorities?

Also, remember that a financial plan is not a one-time event. Conditions change. You probably will repeat the process at different stages of your company and see results differently.

Plan Variables & Important Elements:

All of these variables will help guide your company’s actions. Some of the important elements to include in your plan should be:

- amount of capital required for operations;

- the planned use of this recipe;

- future earnings; swing:

- a detailed account of your debts and receipts;

- cash flow.

Furthermore, revenue projections must be detailed and broken down quarterly in the first two years, and then the plan must offer annual projections for years three to five. Among other things, a financial plan should explain how you will finance your venture.

The Process: This is how you may generate your Business Plan Financial Analysis

As a matter of fact, this process is more efficient when implementing a tool, such as software, So, get at us today for an auto-generated financial analysis. That is to help you monitor your finances, allowing you to assess your progress and quickly resolve problems. Here are six steps to making your plan ideal.

- review your strategic plan;

- develop financial projections;

- organize financing;

- contingency plan;

- compare actual results with your projections;

- invest in software.

Good metrics through an organized strategy.

Finally, it is important to know how to do financial planning so that your company can maintain good fiscal health. Also, always be aware of your goals, your current situation, and the market. Thus, you will be able to follow and stand out in your sector with good metrics through an organized strategy. This is how you may generate your Business Plan Financial Analysis

RELATED POSTS:

Furthermore, these posts will help you understand how to work on this subject matter. Click any of your choice and you are there.

- The basic elements of e-commerce.

- How to generate your business Plan financial assumptions

- Affordable Rice Mill Business plan

- BASICS OF ENTREPRENEURSHIP TRAINING FOR NIGERIAN YOUTH

- 6 factors that will make your start-up grow above average.

- Starting a poultry feed mill – a sample business plan template

- Business plan for business growth.

- Business Plan Model for Micro finance Loan.

How to Contact us On This is how you may generate your Business Plan Financial Analysis

Did you like the post? And as you already know, every time we publish articles related to planning, budgeting and economic-financial monitoring. Then, others are posted on C.A.C incorporation services, accounting and auditing, and tax management. We also publish downloadable materials such as spreadsheet templates, white papers, and e-books on agro-export. You can access these materials by contacting +234 8034347851 or cfmclimited@gmail.com

Finally, if you enjoyed this write-up bookmark it, share, and like us on our social media handles. In fact, you can now place orders for your business plans of any scope. Our financial models are auto-generated. So, you will have a professionally written business plan of a global standard in 3 days. You can now bookmark This is how you may generate your Business Plan Financial Analysis. And, follow us, like us, and help us share this article.

Deacon Anekperechi Nworgu, a seasoned economist who transitioned into a chartered accountant, auditor, tax practitioner, and business consultant, brings with him a wealth of industry expertise spanning over 37 years.