ACCOUNTING FINANCIAL STATEMENTS – Part 4 – INCOME STATEMENT

In our three

previous articles on this topic, we have defined financial statement to include Balance Sheet, Income Statement,

Statement of Changes in Equity and Cash Flow Statement, and have discussed Balance Sheet,

Purpose of financial statements, and the users of financial statements. We present these articles as part of our roles in educating our numerous clients, other business proprietors, and the public .We welcome enquiries for further information and especially on what we can do to help our client’s businesses grow. We also have in mind, enriching the knowledge of various students who will read these articles especially Institute of Chartered Accountants of Nigeria (ICAN )and Chartered Institute of Taxation of Nigeria (CITN) students.

The question is, what is the purpose of financial statements?

As a matter of fact, the general purpose of the financial statements is to provide information about the results of operations, financial position, and cash flows of an organisation. This information is used by the readers of financial statements to make economic decisions regarding the allocation and reallocation of resources in their investments.

ACCOUNTING FINANCIAL STATEMENTS – Part 4 – INCOME STATEMENT

In our previous article we presented the four basic elements of financial statements as follows:

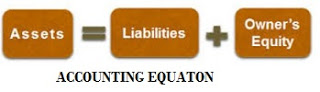

1. A balance sheet, also known as a statement of financial position, displaying reports on a company’s assets, liabilities, and owners equity at a given point in time.

2. An income statement, also called statement of comprehensive income, statement of revenue and expense, or profit and loss account, for a period of time. A profit and loss statement provides information on the operations of the enterprise. These include sales (revenue) and the various ( direct cost of production and administrative or operational) expenses incurred during the stated period.

3. A Statement of changes in equity, also known as equity statement or statement of retained earnings, which gives detailed reports on the changes in equity of the company during the stated period.

4. A

cash flow statement is a report on a company’s cash flow activities, especially its operating, investing and financing activities.

ACCOUNTING FINANCIAL STATEMENTS – Part 4 – INCOME STATEMENT

We have dealt with Balance Sheet in our first article, at this time we shall be dealing with another element of financial statement called Income Statement.

INCOME STATEMENT:

The income statement presents the financial results of a business for a stated period of time. The income statement is an essential part of the financial statements that an organisation releases.

The income statement may be presented by itself on a single page, or it may be combined with other comprehensive income information. In the latter case, the report format is called a statement of comprehensive income

There is no required template in the accounting standards for how the income statement is to be presented. Instead, common usage dictates several possible formats.

ACCOUNTING FINANCIAL STATEMENTS – Part 4 – INCOME STATEMENT

Presentation of Income Statement:

When presenting information in the income statement, the focus should be on providing information in a manner that maximizes information relevance

to the reader. This may mean that the best presentation is one in which the format reveals expenses by their nature, as shown in the following example. This format typically works best for a smaller business.

Revenue XXX

Expenses:

Change in finished goods inventories XXX

Raw materials used XXX

Employee benefits expense XXX

Depreciation expense XXX

Telephone expense XXX

Other expenses XXX

Total expenses (XXX)

Profit before tax XXX

However, relevance to the reader may dictate that a better approach is to present expenses by function, in which case the layout changes to something similar to the following example. This format usually works best for a larger organisation that has multiple departments.

Revenue XXX

Cost of sales (XXX)

Gross profit XXX

Administrative expenses XXX

Distribution expenses XXX

Research and development expenses XXX

Other expenses XXX

Total expenses (XXX)

Profit before tax XXX

The Two Parts Element

Notice that this account is in two parts:

The first part which is commonly called trading account reveals, the level of trading activities and gross profit as its result.

The second part is the profit or loss segment which includes other management expenses. These management expenses are always watched because a business could be doing well as can be seen in the trading account, but seen as doing badly due to over bloated management expenses.

Of the presentation methods just described, showing expenses by their nature is the simplest to account for, since it involves no allocations of expenses between segments of the business. However, showing expenses by their function makes it easier to determine where costs are consumed within an organization, and so contributes to the control of costs.

It is useful to include in either form of presentation however many aggregated line items and subtotals necessary to most clearly convey to the reader the financial performance of the reporting entity.

ACCOUNTING FINANCIAL STATEMENTS – Part 4 – INCOME STATEMENT

In summary

Income Statement reveals the following information:

– informs the reader about the ability of a business to generate a profit. – because as its name implies it could reveal profit or loss.

– it reveals the volume of sales,

– It reveals the nature of the various types of expenses – expenses are classified in categories or even departmentally.

– it shows the classification or aggregation of expense – this enhances analytical processes.

– When reviewed over multiple time periods, it can be used to analyse trends in the results of company operations.

Keep in

touch with this website for your necessary accounting and auditing information. Click one of the social media buttons on this page to like us or to follow us.

Deacon Anekperechi Nworgu, a seasoned economist who transitioned into a chartered accountant, auditor, tax practitioner, and business consultant, brings with him a wealth of industry expertise spanning over 37 years.