How VAIDS will Grow Nigeria’s Tax-GDP Ratio – VAID is the acronym for Voluntary Assets and Income Declaration Scheme, which is aimed at encouraging tax evaders to begin to pay taxes accurately and sufficiently, in exchange for forgiveness of their past tax offences.

VAIDS AND GDP:

How does this affect the national gross domestic income (GDP)? GDP is a measurement of the aggregate of income generated in a country in a period, usually, a yearly period.

This write-up addresses how VAIDS will promote tax payment compliance, and by that cause the generation of more revenue for massive economic activities. This post is good for all taxpayers, tax professionals, accountants and auditors, business consultants, and students of these professional bodies.

What is TAX-GDP RATIO? Please Explain?

The proportion of tax generation in a nation within the measurement period is what is called Tax-GDP Ratio. It’s expressed as amount of tax revenue over total gross domestic product in the period.

i.e Tax Revenue = Tax-GDP Ratio

GDP

Tax Equity Principle Generates More Revenue: Is it true?

Nigeria’s tax system is based on global best practice. It is a progressive system that ensures fairness. There are two types of fairness here. One is Horizontal Fairness in which case every tax payer in similar situations are treated similarly.

The second type of fairness is the Vertical equity. It is one that requires that those who earn higher should also pay higher.

Tax policy is said to be unfair if it becomes regressive. In this situation, taxpayers don’t pay proportionately in relation to their income. It’s a situation where tax payment takes a declining proportion as the value of the tax base rises. In this case the average rate of tax gets greater than the marginal rate of tax.

The marginal rate of tax is defines as change in tax paid over change in income, while average rate of tax is total tax paid over total income.

In summary, those with the highest income levels should shoulder the greatest proportion of the tax burden. If this happens under VAIDS government will be generating more revenue.

How VAIDS will Grow Nigeria’s Tax-GDP Ratio

In Nigeria PAYE is accurate but CIT and PIT are not? Why?

Considerable progress are always made with taxing those in formal employment through the Pay As You Earn scheme at which such personal income taxes (PIT) are deducted at source.

But this is not so of those self-employed persons, professionals and some companies who are able to evade full tax payment due to the inability of the tax authorities to assess their true income and thereby tax them accurately.

According to the

Joint Tax Board (JTB), as at May 2017 the total number of taxpayers in Nigeria is just 14 million out of an estimated 69.9 million who are economically active. This means that only 20.03% of taxable persons in Nigeria pay tax.

The point is, if tax compliance increases due to the operation of VAIDS the government will be generating more revenue.

Nigeria’s Current Tax-GDP Ratio: Said who?

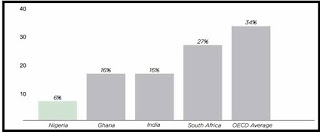

Nigeria’s tax to GDP ratio is at just 6%. This is said to be one of the lowest in the world (compared to India’s of 16%, Ghana’s of 15.9%, and South Africa’s of 27%). Most developed nations have tax to GDP ratios of between 32% and 35%. VAIDS should be able to raise this to at least 15%. Look at this table curled from VAID publication.

How VAIDS will Grow Nigeria’s Tax-GDP Ratio

VAIDS Should be able to take care of the following tax evasion practices: How?

- Manipulating accounting records:

- Use of complex structures in transactions to evade taxes.

- Non registration for VAT,

- Charging of VAT without remitting to FIRS.

- Business operating without TIN

- Operating with unregistered business names

- Operating with unincorporated company names.

- Non payment of Capital Gains Tax (CGT) on asset disposals – many are not aware of this.

- On the other hand, many states (SBIRS) have lacked the machinery to accurately track the true income of their residents.

The point I’m making is that if VAIDS is able to curtail or stop all of these, tax revenue will increase and the tax-GDP ratio will grow.

What has VAIDS to do with peoples’ lifestyle? Watch out!

I once witnessed this. An expatriate who lives in a house rented at N8,000,000 per annum, uses a care valued at N12,000,000 paid a certain amount of tax which the tax authority queried. The subject matter what that the amount of tax paid is at variance with his lifestyle.

Equally, Nigeria’s low tax revenues are at variance with the lifestyles of a large number of its people and with the value of assets known to be owned by Nigerians resident around the world.

VAIDS is expected to enable such assets owners to honestly declare for their ownership and true value and pay commensurable tax on them. This again will make VAIDS generate more revenue to alter the current poor tax-GDP ratio.

Strategic Tax Evasion Methods: What are they?

There has been a systemic breakdown of compliance with the tax system with various strategies used by Nigerians to evade tax obligations. These include but are not limited to, transfer of assets overseas, the use of offshore companies in tax havens to secure assets, and the registration of assets in nominee names.

VAIDS will be doing this country a great good if all of these are reversed.

What Tax Revenue Does? Yea! Tell me.

I need not remind you about what tax revenue does for a people. Tax revenue will lead to

- Massive provision of public goods and services

- Massive infrastructural development

- Proper redistribution of income and wealth

- Promotion of social and economic welfare

- Economic stability

- Political stability

- Good governance

- Stoppage of social and political agitations,

- And lots more.

How VAIDS will Grow Nigeria’s Tax-GDP Ratio

Finally, do you desire articles on Business Tips, Business plan and feasibility study, C.A.C. Incorporation, Accounting and Auditing, Tax Management, Mining, travels and tours, feasibility analysis, real estate management, contact cfmclimited@gmail.com or +234 8034347851

Deacon Anekperechi Nworgu, a seasoned economist who transitioned into a chartered accountant, auditor, tax practitioner, and business consultant, brings with him a wealth of industry expertise spanning over 37 years.