FEASIBILITY STUDY ON PALM OIL PRODUCTION IN NIGERIA

Table of Contents

palm oil production process, start palm oil business, palm oil processing plant cost, palm tree plantation in Nigeria, which state is the highest producer of palm oil in Nigeria. As a matter of fact, people also ask, How palm oil is extracted? How do you grow palm oil? Is palm oil bad for you?

FEASIBILITY STUDY ON PALM OIL PRODUCTION IN NIGERIA

Feasibility study is an assessment of the practicality of a proposed business.

In this article I’m going to give you details of the components of a winning feasibility study, and illustrate them with quantitative and graphical examples. In the light of this,I have therefore included here a lot of illustrative examples for your better understanding. These illustrations are to let you know to what extent you could go to assess the feasibility of your project. No two feasibility study is the same. The content, tables and figures vary depending on your capital outlay and other factors. You could make contacts for further inquiries.

Introduction:

Palm oil is a yellow butter-like oil derived from the fruit of the oil palm and used as an edible fat and by manufacturing industries in household products like candles, pharmaceutical products, confectioneries, cosmetics etc.

Various techniques may be used to process palm oil fruits for edible oil, and may be grouped into four categories according to throughput and degree of complexity of the unit operational machinery: traditional methods, small-scale mechanical units, medium-scale mills and large industrial mills. Generally, processing units handling up to 2 tonnes of fresh fruit bunches per hour are considered to be small-scale, while large-scale mills are able to process more than 10 tonnes per hour.

Usually,your feasibility study should be able to highlight all of these methods but then concentration will be on the type being projected for in the study.

FEASIBILITY STUDY ON PALM OIL PRODUCTION IN NIGERIA

FEASIBILITY STUDY:

Related to feasibility study contents are:

components of a feasibility study, project feasibility study, sample feasibility study of a project, feasibility study template, how to do a feasibility study, importance of feasibility study, types of feasibility study,feasibility study pdf.

A feasibility study is an analysis of the viability of an idea. Feasibility study answers the essential question of “should we proceed with the proposed project idea?”

In fact, a feasibility study aims to objectively and rationally uncover the strengths and weaknesses of an existing business or a proposed one.Feasibility study will let you identify the following before you start writing your business plan.

- How, where, an d to whom you intend to sell a service or product.

- Who are your competition.

- How much money you need to start your business and keep it running until it is established.

- Where and how the business will operate.

- Provide in-depth details about the business to determine if and how it can succeed,

- Serves as a valuable tool for developing a winning business plan.

- List in detail all the things you need to make the business work;

- Identify logistical and other business-related problems and solutions;

- Develop marketing strategies to convince a bank or investor that your business is worth considering as an investment.

Feasibility study is always a component of Business Plan and Business Proposal

Components of Feasibility Study:

Title Page

Content Page

Executive Summary

Technical feasibility

Legal feasibility

Operational feasibility

Schedule feasibility

Resource feasibility

Financial feasibility

Market research studies

(1) TITLE PAGE:

This is the front/cover page.

It shows the name of the company and the Logo, the title of the feasibility study, the author, period covered and date. This page must be well designed to give good impression of what is inside of it.

(2) CONTENT PAGE:

This is the list of the topics in the document and their page references. Every item in the document must be identified here for easy referencing.

(3) THE EXECUTIVE SUMMARY

1. Introduction: this gives the summary or general highlight of all that is done in the research study.

2. Name of the business/firm

3. Nature of business

4. Business address

5. Business/study objective

6. Vision

7. Mission,

8. Purpose.

Take time to write these with relevant details.

(4) TECHNICAL FEASIBILITY:

This assessment is based on the design system requirements. It is to determine whether the company has or could afford the technical expertise to handle completion of the project.

- The part of the business being examined

- The human and economic factor involved or available

- The possible solutions to the problem

- The concern is whether the proposal is both technically feasible.

- This has to be accompanied with relevant technical drawings, maps, designs etc. displayed.

- The cost implications will only be highlighted but must be built into the financial aspect of the feasibility study.

- The processing procedures such as:

The Palm Fruit Processing Stages

- The first stage: Bunch Reception: the palm will be cut from the tree in bunches .

- The second stage: Threshing: cut it from the bunk and after few days it will be selected.

- The third stage: Sterilization: cook the selected with an industrial pot/kettle for sterilization.

- The fourth stage: fruit digestion and pulp pressing.

- The fifth stage: Oil clarification (sieving).

The sixth stage: package in a container and the oil is ready for sale. After this process, the kernels and the chaff will be separated from others for domestic uses and consumption in these steps below;

First stage: Nuts and fibre recovery from the threshing & clarification

Second stage: Palm kernel nuts drying (using heat from sunlight)

Third stage: Palm nut cracking (using kernel crusher)

Fourth stage: Kernel separation (shells from nuts)

Fifth stage: Kernel storage (for sales or further processing to CPKO).

There are modern ways of doing these things mechanically using modern equipment. Whichever model you are using must be well explained.

(5) LEGAL FEASIBILITY:

This aspect is to determine whether the proposed system conflicts with legal requirements of the business/project. It must comply with the local protection, regulations and if the proposed venture is acceptable in accordance to the laws of the land.

This will highlight the relevant regulatory bodies and laws, patent rights and other intellectual property laws involved. It will also show the cost implications if there are needs for franchise, business registration etc.

(6) OPERATIONAL FEASIBILITY:

The operational feasibility assessment focuses on the degree to which the proposed business fits in with the existing business environment and objectives with regard to development schedule, delivery date, corporate culture and existing business processes.

To ensure success, desired operational outcomes must be imparted during the planning stage. These include such design-dependent parameters as reliability, maintainability, supportability, usability, reducibility, indispensability, sustainability, affordability and others. These parameters are required to be considered at the early stages of design if desired operational behaviours are to be realized.

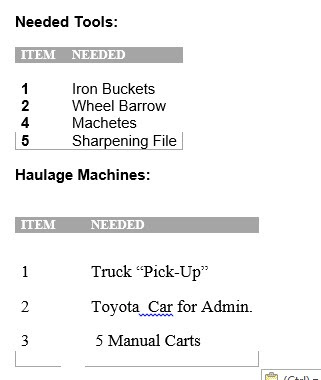

It will also show list of equipment needed such as:

|

S/N

|

EQUIPMENTS

|

|

1

|

Palm oil plant production line: includes Thresher, Boiler & Kettle, Digester, Fibre separator, Pressers,

|

|

2

|

Palm kernel crusher/cracker

|

|

3

|

Palm kernel nut crusher and separators

|

|

4

|

Electricity (Diesel Generator)

|

|

5

|

Storage Tank

|

|

6

|

Overhead water Tank, Water pump

|

|

|

|

Other Facilities:

In addition to obtaining appropriate equipment for the palm fruit processing just described above, a facility will also be needed to house the mill. It is estimated that a simple building of about 1000 square meters would be sufficient to house the equipment, and to provide room for both an office and limited storage. There will be 2 bore holes and a medium size generator to power the operations. Documentation and record-keeping would be best facilitated with a computer and printer.

(7) SCHEDULE FEASIBILITY:

A business will fail if it takes too long to be planned before it is useful. Typically this means estimating how long the business will take to start. Schedule feasibility is a measure of how reasonable the planning timetable is going to take. It is to say ‘given our technical expertise, are the project deadlines reasonable? This area shall have some topics like this.

MILESTONE

The milestone schedule of the palm mill if the business is to start operation in 201

- Initial capital to be made ready in July 2017

- Purchase of the equipment must be completed in August 2017

- Equipment installation must be completed mid September 2017

- Test rum to be completed by September ending.

- 2 bore holes must be ready before September 2017

- Every start-up processes should be complete between now and ending of September 2017.

- Full scale production shall start 1 October 2017

- For expansion purpose one additional equipment to be bought every first month from year two to year five.

(8) RESOURCE FEASIBILITY:

This involves questions such as how much time is available to build the new business, when it can be built, type and amount of resources required and the source of such funds.

The following is an illustrative table of source of funds:

|

Source

|

Amount (N’000)

|

|

|

|

|

|

|

Year

|

1

|

2

|

3

|

4

|

5

|

Total (N’000)

|

|

Equity contribution

|

1.00

|

|

|

|

|

1.00

|

|

Investors: Family

|

7.60

|

|

|

|

|

7.60

|

|

Mr. ABC

|

4.50

|

3.00

|

3.00

|

3.00

|

3.00

|

16.50

|

|

Other Sources

|

3.00

|

3.00

|

3.00

|

0.9

|

|

9.90

|

|

Total Financing

|

16.1

|

6.00

|

6.00

|

3.90

|

3.00

|

35.0

|

|

|

|

|

|

|

|

|

This table shows that N35,000,000.00 is required for this business, and will be provided over 5 years period, and by who.

(9) MARKET RESEARCH STUDIES:

This is one of the most important sections of the feasibility study as it examines the marketability of the product or services and convinces readers that there is a potential market for the product or services. If a significant market for the product or services cannot be established, then there is no project.

Typically, market studies will assess the potential sales of the product, absorption and market capture rates and the project’s timing.FEASIBILITY STUDY ON PALM OIL PRODUCTION IN NIGERIA

Therefore, this aspect of the feasibility study will show the following:

MARKETING PLAN

Marketing plan section will have sub-sections that explain the product to be sold, pricing, promotion and distribution plans to achieve good sales.

(A) PRODUCTS & SERVICES

This section will show things like;

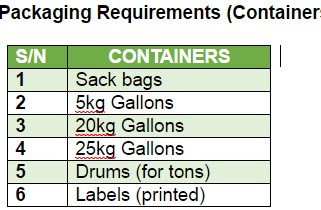

“The products include Crude Palm Oil (CPO), Crude Palm Kernel Oil (CPO), Special Palm Oil (SPO), Palm Kernel Nut (PKN), Palm Kernel Cake (PKC) and, Palm Kernel Shells (PKS). The management is looking at the products in drums (tons), and 20litre kegs. This is to enable both small, medium and large scale customers to have full access to the quantity they want to purchase”.

Other sources of product must be listed here such as:

– Would you be buying processed products from third parties such as the community markets, other processing firms, local farms etc.?

– Would you be buying unprocessed fruits/bunches in like manner?

– Would you be processing palm fruits for third parties commercially?

– Would you be storing products – your products and those you buy from third parties to sell in future?

Then you highlight the Uses Of The Finished Palm Products.

The products will be used to produce other primary and secondary products in the food and drug industry and for other industrial purposes

1. Food Products

- Cooking Oil

- Deep Frying Oils

- Margarines and spreads Bakery fats

- Cocoa butter alternative fats

- Confectionary fats

- Ice cream fats Infants nutrition fats

- Other food applications

2. Non Food Products

- Soaps Candles

- Pharmaceuticals

- Lubrication and Grease Surfactants

- Industrial

- Chemicals

- Agrochemicals

- Coatings

- Paints and lacquers

- Electronics

- Leather

- Biodiesel

OTHER PRODUCTS

Apart from palm oil, palm kernel and palm kernel oil which are the main products of the oil palm, the processing wastes generated from the trees and during palm fruits processing (to obtain palm oil and palm kernel oil) have several uses. The sludge is used in making traditional soaps and fertilizer and the Palm Kernel Cake is used widely as an input into the animal feed industry and for fertilizers. The processing wastes include empty bunch refuse, fibre, shell, sludge and mill effluent.

In addition, the other parts of the palm tree (trunk, leaves, fibre) have broad uses, while the bunch refuse, and by-products from the oil processing (fibre, shell, sludge) can be used as fuel for the mills, making briquettes to substitute for fuel wood,

(B) PRICING

This section discusses the pricing plan for the products that will be processed..

PRICING OF PALM OIL

The pricing of palm oil is seasonal. You have to show in a table like the one below, how oil palm prices fluctuate between the season period and the off season period, and the category of buyers. Use your own researched figures.

Pricing of Palm oil:

|

S/N

|

CATEGORY OF ACTOR IN THE VALUE CHAIN

|

SEA-SON

|

AVERAGE SELLING PRICE PER 20 LITRE KEG

|

AVERAGE PRICE

|

PRICE PER 1 TON

|

|

|

Low

|

High

|

(L + H)/2

|

||||

|

1

|

Farmer/

Processor

|

Peak

|

N6,500

|

N7,000

|

N6,750

|

N315,000

|

|

Off

|

N7,000

|

N7,500

|

N7,250

|

N378,000

|

||

|

2

|

Wholesaler/Dealer

|

Peak

|

N7,500

|

N8,000

|

N7,750

|

N340,200

|

|

Off

|

N8,500

|

N9,000

|

N8,750

|

N389,025

|

||

|

3

|

Retailer

|

Peak

|

N7,000

|

N8,800

|

N7,900

|

N349,650

|

|

Off

|

N9,000

|

N9,500

|

N9,250

|

N396,900

|

||

A proper feasibility study will reveal all these and will give you the basis for estimating your sales/turnover for the period in question. You will do the same for all other products and by-products of palm oil.

The pricing of palm kernel and palm kernel oil is also seasonal depending on the supply of palm fruits. Prices can also nearly double between peak production season (when prices are lowest) and the off season when prices are higher. Consider the following tentative prices.·

1 ton of PKO = N371,700

1 ton of PKC = N50,400

Source: Nigeria local open market.

Your feasibility study will reveal the actual prices.

(C) PROMOTIONS PLAN:

Consider the following statements;

“although the company’s current contacts in the palm oil product chains are for local consumption, expansion to every part of Nigeria and other countries (for exportation purposes) is quite likely in the foreseeable future. The unique marketing approach of using local and foreign distributors, and customer awareness will be maintained using T.V, Radio and Online advertising. Direct researcher/sales personnel will be available in the Company; this is to enhance first-hand information on what the customers are seeking especially in cities and state. The management will develop a fully loaded website highlighting the palm oil processing mills, technical analysis of production process and the organizational chart of the company’s management”.

You must use this medium to explain how you intend to market your products, including your distribution plans.

(10) FINANCIAL FEASIBILITYThis part deals with cost estimations, revenue estimation and financial/investment analysis.

The financial viability can be judged on the following parameters:

- Total estimated cost of the project

- Financing of the project in terms of its capital structure, debt to equity ratio.

- Existing investment by the promoter in any other business – eg industry average.

- Projected cash flow,

- Profitability ratios like gross profit margin, net profit margin and rate of return on investment (RIO).

– Full details of the assets to be financed and how liquid those assets are.

– Project’s funding potential and repayment terms.

Remember a feasibility study is a survey. Information as the following are necessary here:

State the assumptions you are making in order to carry out this survey. All things being equal, it is hoped that based on these assumptions your estimates would be realised. Where the result of this study is not favourable and there is need for adjustments, all of these would also be adjusted.

2. Sales and related marketing expenses are expected to increase by 20% each year due to expected increase in palm fruit supply from third party customers.

3. The registration cost and other start-up processes costs are assumed to be incurred in year one alone.

4. The total cash needed to start up and run the company is N35 million to be provided over the first 5 years.

5. Where bank loan is sought for, interest will be charged at commercial rate.

6. Taxes shall be on the balance sheet of each year

BASIS FOR FINANCIAL ANALYSIS AND PROJECTIONS:

These are assumptions that relate to financial projections and analysis. You must state them.

1. TAX deduction is 30% taking advantage of tax incentives for agriculture and agro-allied firms.

2.Depreciation is charged on all the tangible capital items on a straight line basis on the following;

· Building 2%

· Motor Vehicle 25%

· Plants and Machinery 25%

· Furniture’s and Fittings 20%

· Amortization of intangible capital items are absorbed at 20%.

4. Borrowing rate is at current commercial lending rate.

5. The accounting records are in accrual basis.

6. Every expenditure incurred in the first three years is capitalized and amortized/depreciated accordingly.

You can add more to suit your study.

It is time to go ahead producing relevant tables to buttress your findings and analysis. Such tables could include the following:

FEASIBILITY STUDY ON PALM OIL PRODUCTION IN NIGERIA

|

S/NO.

|

DESCRIPTION

|

AMOUNT

N

|

AMOUNT

N

|

AMOUNT

N

|

|

1

|

Equipment – sterilizing, pressing, clarification plants, generator etc.

|

7,000,000

|

|

|

|

2

|

Other plants, Pick-up Van, 1 No car, 5 manual carts

|

3,000,000

|

|

|

|

3.

|

1 No bore hole

|

650,000

|

|

|

|

4.

|

Factory and Admin building

|

3,500,000

|

|

|

|

5.

|

Admin. Furniture and fittings.

|

500,000

|

|

|

|

5.

|

Admin and factory staff – Salaries

|

2,400,00

|

|

|

|

6.

|

Incorporation expenses

|

120,000

|

|

|

|

7.

|

Utilities and others

|

500,000

|

|

|

|

Year

|

1

|

2

|

3

|

4

|

|

Yield

|

6 tones

|

9 tones

|

12 tones

|

12 tones

|

|

Yields in Litre

|

8,436

|

12,654

|

16,872

|

16,872

|

|

Value in Naira @N12,000/25ltr

|

4,049,280

|

6,073,920

|

8,098,560

|

8,098,560

|

The analysis of this revenue estimates must be shown. Remember they are to be generated by your marketing feasibility study. Now you can understand that there are various feasibility studies to be incorporated in this one feasibility study.

|

YEAR

|

1

|

2

|

3

|

4

|

|

OIL MILL

|

|

|

|

|

|

2 Mill operators

|

480,000

|

480,000

|

528,000

|

528,000

|

|

Raw Materials

|

200,000

|

200,000

|

220,000

|

220,000

|

|

2 Casual labours

|

360,000

|

360,000

|

396,000

|

396,000

|

|

Utilities

|

100,000

|

100,000

|

110,000

|

110,000

|

|

TOTAL

|

1,140,000

|

1,140,000

|

1,254,000

|

1,254,000

|

|

ADMINISTRATION

|

|

|

|

|

|

2 Staff

|

480,000

|

480,000

|

528,000

|

528,000

|

|

1 Driver

|

240,000

|

240,000

|

264,000

|

264,000

|

|

2 Security men

|

360,000

|

360,000

|

396,000

|

396,000

|

|

Utilities

|

100,000

|

100,000

|

100,000

|

100,000

|

|

Professional fees – Auditing etc

|

120,000

|

120,000

|

150,000

|

150,000

|

|

Sub-total

|

1,300,000

|

1,300,000

|

1,438,000

|

1,438,000

|

|

Marketing:

|

|

|

|

|

|

Packaging

|

84,000

|

112,000

|

140,000

|

168,000

|

|

Label

|

10,000

|

12,000

|

15,000

|

18,000

|

|

1 casual labour

|

180,000

|

180,000

|

180,000

|

180,000

|

|

Utilities

|

100,000

|

100,000

|

100,000

|

100,000

|

|

Sub-total

|

374,000

|

404,000

|

432.000

|

466,000

|

|

|

|

|

|

|

Notice that this estimate is in sections.

ANNUAL DEPRECIATION OF FIXED ASSETS:

Sample of Schedule of Annual Depreciation:

The table shows the cost of the depreciation of fixed assets over the projected years.

Tangible Fixed Assets will be depreciated as per normal depreciation rate for such assets, while intangible assets ( other capitalized expenses) will be amortized over 4 years from the year of revenue earning. You could decide that the amortization rate adopted be 10%, 20%,30% and 40% for year 1 to 3 respectively or amortized on equal basis for the specified period.

|

|

ANNUAL DEPRECIATION OF ASSETS

|

|||||||

|

ITEM

|

BOOK VALUE

|

1

|

2

|

3

|

4

|

5

|

||

|

1

|

Land

|

6,000,000

|

,0

|

0

|

0

|

0

|

0

|

|

|

2

|

Building 2%

|

5,500,000

|

110,000

|

110,000

|

110,000

|

110,000

|

110,000

|

|

|

3

|

Plants & Machinery

|

7,000,000

|

700.000

|

700,000

|

700,000

|

700,000

|

700,000

|

|

|

4.

|

Bore Hole 10%

|

2,600,000

|

260,000

|

260,000

|

260,000

|

260,000

|

260,000

|

|

|

5

|

Furniture Fixtures & Fittings

|

500,000

|

75,000

|

75,000

|

75,000

|

75,000

|

75,000

|

|

|

6

|

Motor Vehicle

|

3,000,000

|

300,000

|

300,000

|

300,000

|

300,000

|

300,000

|

|

|

7

|

Amortizable Capital Expenditures.

|

9,160,000

|

1,832,000

|

1,832,000

|

1,832,000

|

1,832,000

|

1,832,000

|

|

|

TOTAL

|

33,760,000

|

3,277,000

|

3,277,000

|

3,277,000

|

3,277,000

|

3,277,000

|

||

|

1.

|

Admin and factory staff – Salaries

|

2,400,000

|

|

|

2.

|

Incorporation expenses

|

120,000

|

|

|

3.

|

Utilities and others

|

500,000

|

|

|

4.

|

Construction of 3 fish ponds

|

300,000

|

|

|

5.

|

Fingerlings

|

20,000

|

|

|

6.

|

Feeds

|

50,000

|

|

|

7.

|

Cows

|

1,000,000

|

|

|

8

|

Goats

|

500,000

|

|

|

9

|

Miscellaneous Expenses

|

100,000

|

|

|

|

TOTAL

|

=======

|

|

These are the start-up expenses capitalized, which must be amortized as per the entity financial policy.

This part will now be used to analyze the entire operations financially.

|

Year

|

1

|

2

|

3

|

4

|

5

|

|

Sales: Oil Mill

|

–

|

–

|

4,049,280

|

6,074,920

|

8,098.560

|

|

Fish pond

|

4,230,000

|

5,400,000

|

6,480,000

|

6,480,000

|

6,480,000

|

|

Kernel and other by-products

|

–

|

–

|

1,197,000

|

1,197,000

|

1,197,000

|

|

Life Stock

|

–

|

–

|

–

|

–

|

–

|

|

TOTAL REVENUE

|

4,230,000

|

5,400,000

|

11,726,280

|

13,751,920

|

15,775,560

|

|

Direct cost of production

|

|

|

|

|

|

|

Plantation

|

–

|

–

|

(1,120,000)

|

(1,120,000)

|

(1,232,,000)

|

|

Oil Mill

|

–

|

–

|

(1,140,000)

|

(1,140,000)

|

(1,254,000)

|

|

GROSS PROFIT (LOSS)

|

4,230,000

|

5,400,000

|

9,466,280

|

11,491,920

|

13,289,560

|

|

Less:

|

|

|

|

|

|

|

Admin Expenses

|

–

|

–

|

1,300,000

|

1,300,000

|

1,438,000

|

|

Marketing

|

–

|

–

|

374,000

|

404,000

|

432,000

|

|

Depreciation:

|

|

|

|

|

|

|

Fixed Assets

|

1,445,000

|

1,445,000

|

1,445,000

|

1,445,000

|

1,445,000

|

|

Amortized Expenses

|

1,832,000

|

1,832,000

|

1,832,000

|

1,832,000

|

1,832,000

|

|

NET PROFIT/(LOSS)

|

953,000

|

2,123,000

|

4,515,280

|

6,510,920

|

8,142,560

|

|

Provision for tax

|

134,000

|

318,450

|

677,000

|

976,638

|

1,221,384

|

|

Net profit after tax

|

810,000

|

1,804,550

|

3,838,280

|

5,534,282

|

6,921,176

|

|

Gross Profit margin

|

–

|

–

|

81%

|

83.6%

|

84%

|

|

Net profit margin before tax

|

22.5%

|

39.3%

|

38.5%

|

51%

|

51.6%

|

|

Return on investment

|

8.1%

|

18%

|

38.38%

|

55.34%

|

69.2%

|

Note the accounting ratios generated here. Gross profit margin, Net profit margin and ROI. These are good investment indicators.

With this you will understand that if you generate unreliable figures that shows that the business is feasible which is not true, the business will soon be in trouble.

|

YEAR

|

1

N

|

2

N

|

3

N

|

4

N

|

5

N

|

|

ASSET EMPLOYED:

|

|

|

|

|

|

|

Plantation

|

11,870,000

|

13,820,000

|

14,120,000

|

14,120,000

|

14,120,000

|

|

Oil Mill

|

4,620,000

|

9,620,000

|

17,670,000

|

17,670,000

|

17,670,000

|

|

Fish and Life-stock

|

1,675,000

|

1,850,000

|

1,970,000

|

1,970,000

|

5,220,000

|

|

|

18,165,000

|

25.290,000

|

33,760,000

|

33,760,000

|

37,010,000

|

|

Life-stock appreciation

|

–

|

–

|

–

|

3,250,000

|

–

|

|

Less Accumulated Depreciation

|

3,277,000

|

9,831,000

|

9,831,000

|

13,108,000

|

16,385,000

|

|

|

14,888,000

|

15,459,000

|

23,929,000

|

23,902,000

|

20,625,000

|

|

Current assets less current liabilities

|

3,022,000

|

10,255,550

|

11,623,830

|

24,335,112

|

37,533,288

|

|

NET ASSETS

|

17,910,000

=======

|

25,714,550

=======

|

35,552,830

=======

|

48,237,112

=======

|

58,158,288

=======

|

|

FINANCED BY

|

|

|

|

|

|

|

Authorized capital

|

1,000,000

|

1,000,000

|

1,000,000

|

1,000,000

|

1,000,000

|

|

Director’s Current account

‘

|

16,100,000

|

22,100,000

|

28,100,000

|

32,000,000

|

35,000,000

|

|

Reserves/Retained profits

|

810,000

|

2,614,550

|

6,452,830

|

11,987,112

|

22,158,288

|

|

Revaluation Surplus

|

–

|

–

|

–

|

3,250,000

|

–

|

|

Shareholders Fund

|

17,910,000

=======

|

25,714,550

=======

|

35,552.830

=======

|

48,237,112

=======

|

58,158,288

=======

|

TABLE SHOWING PROJECT EVALUATION USING PAY-BACK MATHOD

This analysis will show you how long it will take the business to pay back your investment.

|

Year

|

Investment cost in N

|

Revenue

In N

|

Cumulative Balance in N

|

|

1

|

16,100,000

|

4,230,000

|

(11,870,000)

|

|

2

|

6,000,000

|

5,400,000

|

(12,470,000)

|

|

3

|

6,000,000

|

7,115,280

|

(11,354,720)

|

|

4

|

3,900,000

|

8,811,282

|

(6,443,438)

|

|

5

|

3,000,000

|

10,198,176

|

754,738

|

|

Revaluation of life-stock

|

–

|

3,250,000

|

4,004,738

|

This shows that this project pays back in 5 years.

13 CONCLUSION:

This will carry your recommendations based on the feasibility study. Your recommendation could be to go ahead with the project, stop the project, modify the project or any other alternative.

Note also that these tables can be converted to graphs, bar charts, pie charts etc. for better illustration.

Now you can write your business plan, or business proposals. In addition to giving a comprehensive report based on this study, you can also attach some of these reports as part of the business plan main body or as appendix.

GOOD-LUCK – You can now write your business plan on palm oil production. You can make contacts for professional attention if you have need to do so.

Your comments are welcome. You can also make contributions by writing articles which will be edited and published in your name. Click any of the social media platforms on top of this page to like us or to follow us. Maintain a continues link with us by filing the Contact us by email platform too.

Deacon Anekperechi Nworgu, a seasoned economist who transitioned into a chartered accountant, auditor, tax practitioner, and business consultant, brings with him a wealth of industry expertise spanning over 37 years.