How to Develop Business Plan Financial Projections – Here is a financial projection template for business plan financial projections. You can call it a financial plan or financial projections for startups or scaling up existing businesses. Generally, this is how to make a financial plan for a business.

Here also explain what a business plan is, what’s included, and how to write it. Included in this article too are types of business plans, why it’s important, and the components of a business plan. Here are How to Develop Business Plan Financial Projections for your business plan.

What is a business plan:

Table of Contents

This is a formal business document setting out its future objectives and strategies for achieving them. That’s why it includes company goals, visions, and core values. Then, it explains how the operations are carried out (strategies) and gives projections of the cost elements. A bankable business plan must therefore produce financial plan analyses in Income statement/Profit or Loss account, Balance sheet, and cash flow analysis. Then the conclusions.

What is Financial Projection:

Furthermore, on How to Develop Business Plan Financial Projections, this segment of the business plan shows the expected revenues, expenses, and cash flows of a business over a period. This is what makes it a business financial performance tool over a future period. There are financial projections for startups and for scaling up businesses. Our financial projection template automatically produces adjustable projected financial statements. You can place your orders now.

How to Develop Business Plan Financial Projections

The place of financial projection in the business plan:

The importance of financial projections lies in the fact that it’s a business planning tool. So, for a startup business, financial projections help you plan your startup budget. This helps you assess when you can expect the business to become profitable.

The financial projection considers such financial variables as;

- Production costs – Direct and indirect costs; variable and fixed costs.

- Market prices – This projection helps to determine the unit cost of production and unit selling price.

- Revenue projection – The above variables combines to give the expected revenue for the period. The break-even analysis determines the demand level for your product and services.

- Financial Statements: The final part of the projection produces the financial statements. The 3 major financial statements are the Manufacturing/Trading Profit or loss account, the Balance sheet, and the Cash flow analysis. Read more about How to Develop Business Plan Financial Projections

- Ratio Analysis: This is perhaps the summary of the whole thing. It is the comparative analysis for the entire business operation projection. So, you may desire to produce the Gross profit margin and the Net profit margin before or after tax. you can also produce the ROI ( return on investment) or ROE (return on capital employed). You may also need NPV ( net present value), payback period, etc.

As you can see, this analysis will help you achieve a clear understanding of your financial situation and to discover your full profit potential. Complete Full Marks Consultants Limited is capable of generating all of these automatically for your business on short time notice. You can place your order now. This service is especially for those who write a business plan but has difficulty generating the financial analysis.

Sample Business Financial Projection:

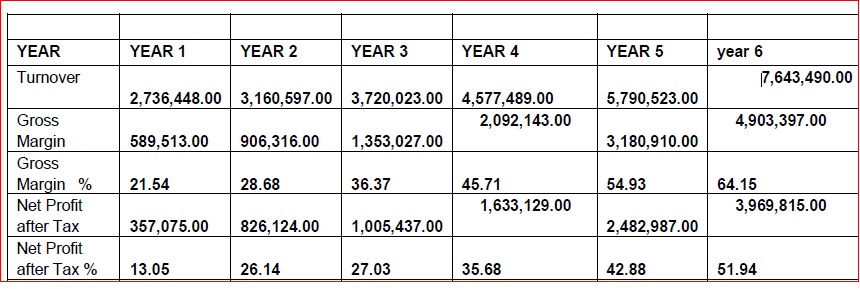

Here are samples of our autogenerated financial tables. The first one is the summary table, good for the executive summary page. You can see that it includes some of the ratio analyses highlighted above.

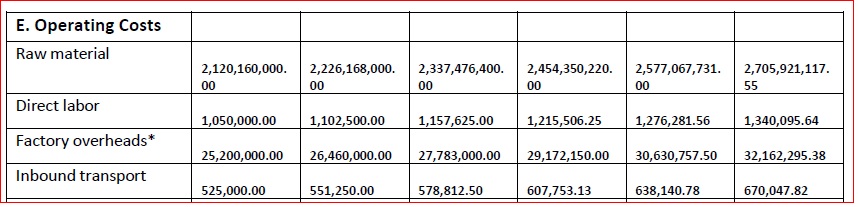

How to Develop Business Plan Financial Projections. The next table is the operational cost analysis generated automatically too. This is an element of the Manufacturing or Trading account.

This is How to Develop Business Plan Financial Projections. Our business plan templates also produce supportive graphs for all of the tables. The other financial analysis, the Profit or loss account, balance sheet, and cash flow analysis can not be displayed here. However, they are available on demand.

How to Develop Business Plan Financial Projections

Mistakes to Avoid in Developing a Business Plan Financial Projections.

When developing financial projections for your business plan, it’s important to be thorough and accurate. Avoiding certain mistakes can help ensure that your projections are realistic and reliable. Here are some common mistakes to avoid:

Overly optimistic revenue forecasts:

While it’s natural to be enthusiastic about your business’s potential, it’s crucial to base your revenue forecasts on realistic market research and analysis. Avoid the temptation to overestimate sales or market share without proper justification. This is How to Develop Business Plan Financial Projections.

Neglecting market trends and competition:

Failing to consider market trends and competition can lead to inaccurate financial projections. Research and analyze your target market thoroughly, including customer preferences, industry trends, and competitive landscape. Understand how these factors can impact your revenue and growth prospects.

Ignoring seasonality and cyclical patterns:

Many businesses experience seasonal or cyclical fluctuations in revenue. Failing to account for these patterns can lead to inaccurate projections. Consider historical data, industry benchmarks, and any other relevant factors to accurately reflect seasonality or cyclicality in your financial forecasts.

Underestimating expenses:

It’s common for entrepreneurs to overlook or underestimate expenses when creating financial projections. Be comprehensive in identifying all costs associated with your business, including overhead, marketing, salaries, supplies, and any other operational expenses. Include contingencies and unexpected costs to ensure your projections are realistic. This is How to Develop Business Plan Financial Projections.

Neglecting scalability and capacity constraints:

If your business has the growth potential, ensure that your financial projections account for scalability. Consider factors such as production capacity, operational efficiency, and resource constraints. Failing to address these issues can result in unrealistic growth projections and financial instability.

Incorrect pricing assumptions:

Pricing plays a crucial role in determining revenue and profitability. Make sure your pricing assumptions are based on a thorough understanding of market dynamics, customer willingness to pay, and production costs. Validate your pricing strategy by conducting market research and analyzing competitor pricing. This is How to Develop Business Plan Financial Projections.

Inadequate cash flow management:

Cash flow is essential for the survival and growth of any business. Failing to accurately project and manage cash flow can lead to serious financial problems. Consider factors such as payment terms, accounts receivable, inventory turnover, and any other cash flow drivers specific to your industry.

Relying solely on internal expertise:

While it’s important to utilize your knowledge and experience, it’s also essential to seek external input. Engage with industry experts, consultants, mentors, or advisors who can provide valuable insights and challenge your assumptions. This external perspective can help identify blind spots and improve the accuracy of your financial projections. This is How to Develop Business Plan Financial Projections.

Lack of sensitivity analysis:

Financial projections inherently involve uncertainty. It’s important to conduct sensitivity analysis by assessing how changes in key variables, such as revenue, expenses, or market conditions, can impact your financial outcomes. This analysis helps you understand the potential risks and provides a more realistic view of your business’s financial performance.

Failing to revisit and update projections:

Your financial projections should not be static. As your business evolves, market conditions change, or new information becomes available, it’s crucial to review and update your financial projections accordingly. Regularly reassess your assumptions and refine your forecasts to maintain accuracy and relevance. This is How to Develop Business Plan Financial Projections.

We understand that by avoiding these common mistakes, you can develop more reliable and credible financial projections that will support your business plan and provide a solid foundation for your strategic decision-making.

Help Factors While Making a Business Plan Financial Projection:

When creating financial projections for your business plan, several key factors should be taken into consideration. These factors will help you ensure that your projections are accurate, realistic, and comprehensive. We wish you consider the following factors;

Market analysis: How to Develop Business Plan Financial Projections.

Conduct a thorough analysis of your target market. Understand the size, growth rate, and dynamics of the market. Identify your target customers, their preferences, and their purchasing behaviors. Consider any industry trends or market disruptions that may impact your business.

Sales forecast:

Develop a detailed sales forecast based on your market analysis. Consider factors such as customer acquisition strategies, pricing, market share, and potential barriers to entry. Break down your sales forecast by product or service categories, customer segments, and geographic regions, if applicable.

Pricing strategy:

Determine an appropriate pricing strategy for your products or services. Consider factors such as production costs, competitor pricing, customer value perception, and market positioning. Assess the impact of different pricing scenarios on your revenue and profitability.

Cost structure: How to Develop Business Plan Financial Projections.

Identify and estimate all the costs associated with your business operations. Include both fixed costs (e.g., rent, utilities, salaries) and variable costs (e.g., raw materials, production costs). Consider any economies of scale, cost-saving measures, or efficiency improvements that may affect your cost structure.

Capital expenditures:

Determine the capital expenditures required to start or expand your business. This includes investments in equipment, machinery, technology, infrastructure, or any other assets necessary for your operations. Consider the timing and costs associated with these capital expenditures.

Operating expenses:

Estimate your ongoing operating expenses, including marketing and advertising, research and development, administrative costs, and overhead expenses. Consider any specific industry-related expenses that may apply to your business.

Cash flow management:

Pay close attention to your cash flow projections. Consider the timing of cash inflows and outflows. Account for factors such as payment terms, accounts receivable, inventory turnover, and any other cash flow drivers specific to your industry. Maintain a cash flow reserve to manage unforeseen expenses or fluctuations. This is How to Develop Business Plan Financial Projections.

Financing and funding:

Determine how you will finance your business and incorporate it into your financial projections. Consider sources of funding such as personal investment, loans, grants, or equity investment. Include any interest or repayment obligations in your financial projections. Very important on How to Develop Business Plan Financial Projections.

Key performance indicators (KPIs):

Identify the key metrics that will help you track and assess the performance of your business. These may include revenue growth rate, gross margin, customer acquisition cost, customer lifetime value, return on investment, or any other relevant KPIs for your industry.

Sensitivity analysis: How to Develop Business Plan Financial Projections.

Perform sensitivity analysis to understand the impact of changes in key variables on your financial projections. Assess how variations in sales, costs, pricing, or market conditions can affect your outcomes. This analysis will help you identify potential risks and develop contingency plans.

You have to remember that financial projections are not set in stone and should be regularly reviewed and updated as your business progresses. So, by considering these factors and continuously monitoring your financial performance, you’ll be better equipped to make informed decisions and steer your business toward success.

Related topics:

Our related topics are well chosen to help you get more information the the subject matter under discussion. So, you are advised to visit them for good.

- How to write Business Plan Exit strategy

- A business plan Strategy and Implementation Segment – how to write

- How to write Business Plan Organization Structure

- Apply for CBN Targeted Credit Facilities here

- Cooking gas business plan templates

- Other business Tips

Order Now:

Finally, on How to Develop Business Plan Financial Projections, you can order now for your copy, In Completefmc.com we structure a bankable business plan for all businesses, especially for startups. In fact, for every lean start-up plan we develop, we add startup accelerator strategies. These we build into the business startup ideas generated by us. Therefore with Completefmc.com starting up a business is an experience. Added also are startup funds for lean start-ups and franchise opportunities. If you are interested, then contact [email protected] or +234 8034347851. This is How to Develop Business Plan Financial Projections.

Deacon Anekperechi Nworgu, a seasoned economist who transitioned into a chartered accountant, auditor, tax practitioner, and business consultant, brings with him a wealth of industry expertise spanning over 37 years.