This NIRSAL AGSMEIS Financial Model for Rice Mill Business Plan is a free rice processing business plan. In fact, it’s a complete financial model; feasibility study on rice production in Nigeria. It also serves as AGSMEIS Rice Mill business plan template. This NIRSAL AGSMEIS Financial Model for Rice Mill Business Plan is what you need to win your NIRSAL loan application.

Suitable Financial Models:

Table of Contents

Furthermore, this financial model is applicable for AGSMEIS, Anchor Borrowers fund, Agricultural cooperative funds and many other such funds from CBN, NIRSAL micro finance bank and any other commercial bank loan programmer in Nigeria. We have every facility to help you download and work on this model. In fact, our automated business plan model is what you need here. You are advised to contact us if you have need of this.

The Sample Financial Model @ NIRSAL AGSMEIS Financial Model for Rice Mill Business Plan

As a matter of fact, financial modeling is the task of using your proposed operational variables to build your expected financial parameters. In fact, it’s a business mathematical model designed to represent the performance of your financial asset or business, project, or any other investment.

In fact, we have here a sample of rice mill business financial model. Since we know that no two business plans are the same, this is just a template. With your particular business variables, we will be able to generate yours in a matter of a few hours. Order your NIRSAL AGSMEIS Financial Model for Rice Mill Business Plan today.

Projected Profit and Loss For NIRSAL AGSMEIS Financial Model for Rice Mill Business Plan

Furthermore, we automatically generate your income statement like this one here. With all the variables and assumptions input, this is what you will have. In fact, the investor is watching your gross profit and net profit margins to make their investment decisions. So, get your NIRSAL AGSMEIS Financial Model for Rice Mill Business Plan today.

As a matter of fact, it’s actually a professional thing, so you can contact us to generate yours immediately.

| FY2021 | FY2022 | FY2023 | |

| Revenue | N238,020,000 | N183,020,000 | N194,350,000 |

| Direct Costs | N4,812,000 | N9,996,000 | N22,956,000 |

| Gross Margin | N233,208,000 | N173,024,000 | N171,394,000 |

| Gross Margin % | 98% | 95% | 88% |

| Operating Expenses | |||

| Salaries & Wages | N2,160,000 | N2,484,000 | N2,856,600 |

| Employee Related Expenses | N432,000 | N496,800 | N571,320 |

| Utilities | N180,000 | N180,000 | N180,000 |

| Rent | N240,000 | N240,000 | N240,000 |

| Marketing | N144,000 | N144,000 | N144,000 |

| Amortization of Other Current Assets | N1,500,000 | ||

| Total Operating Expenses | N4,656,000 | N3,544,800 | N3,991,920 |

| Operating Income | N228,552,000 | N169,479,200 | N167,402,080 |

| Interest Incurred | |||

| Depreciation and Amortization | N2,670,474 | N2,670,474 | N2,670,473 |

| Gain or Loss from Sale of Assets | |||

| Income Taxes | N33,882,229 | N25,021,309 | N24,709,741 |

| Total Expenses | N46,020,703 | N41,232,583 | N54,328,134 |

| Net Profit | N191,999,297 | N141,787,417 | N140,021,866 |

| Net Profit / Sales | 81% | 77% | 72% |

Projected Balance Sheet NIRSAL AGSMEIS Financial Model for Rice Mill Business Plan

Furthermore, this is where you get the statement of your affairs at a particular time. In fact, if you must win any loan application, your parameters on this sttement must be posative.

| FY2021 | FY2022 | FY2023 | |

| Cash | N226,078,590 | N361,418,486 | N503,152,032 |

| Accounts Receivable | N733,000 | N490,075 | N537,300 |

| Inventory | |||

| Other Current Assets | N0 | N0 | N0 |

| Total Current Assets | N226,811,590 | N361,908,561 | N503,689,332 |

| Long-Term Assets | N13,242,650 | N13,242,650 | N13,242,650 |

| Accumulated Depreciation | (N2,670,474) | (N5,340,948) | (N8,011,421) |

| Total Long-Term Assets | N10,572,176 | N7,901,702 | N5,231,229 |

| Total Assets | N237,383,766 | N369,810,263 | N508,920,561 |

| Accounts Payable | N2,240 | N2,240 | N2,240 |

| Income Taxes Payable | N33,882,229 | N25,021,309 | N24,709,741 |

| Sales Taxes Payable | N0 | N0 | N0 |

| Short-Term Debt | |||

| Prepaid Revenue | |||

| Total Current Liabilities | N33,884,469 | N25,023,549 | N24,711,981 |

| Long-Term Debt | |||

| Long-Term Liabilities | |||

| Total Liabilities | N33,884,469 | N25,023,549 | N24,711,981 |

| Paid-In Capital | N12,000,000 | N12,000,000 | N12,000,000 |

| Retained Earnings | (N500,000) | N190,999,297 | N332,186,714 |

| Earnings | N191,999,297 | N141,787,417 | N140,021,865 |

| Total Owner’s Equity | N203,499,297 | N344,786,714 | N484,208,580 |

| Total Liabilities & Equity | N237,383,766 | N369,810,263 | N508,920,561 |

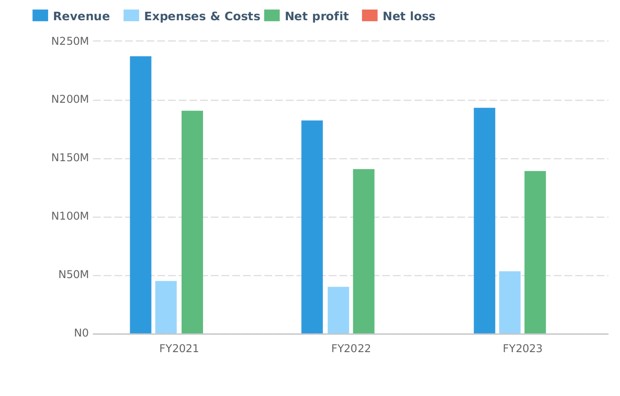

Financial Highlights by Year

Furthermore, this is where we feed the eye views of your activities. The colours represent different things all together.

RELATED TEMPLATES:

- Over 50 AGSMEIS LOAN BUSINESS PLAN TENPLATES

- OUR AGSMEIS TRAINING CENTRE

- DRY CLEANING BUSINESS PLAN FOR AGSMEIS NIRSAL LOAN

- How does AGSMEIS Loan work?

- Get more here

- Apply for AGSMEIS On-line training here

- What You should do to get AGSMEIS Loan

- Who is Eligible for AGSMEIS Loan

- Current AGSMEIS Loan Requirements

COMPLETE FULL MARKS CONSULTANTS (CFMC) LIMITED:

Furthermore, CFMC LTD is a firm of chartered accountants and management consultants. Professionally, we are trained to generate financial models. So, contacting us makes a lot of sense. Therefore, we have the ability to coach you on your business operations. We, therefore, render special services for NIRSAL bank loan applicants.

OUR CONTACTS: NIRSAL AGSMEIS Financial Model for Rice Mill Business Plan

+234 8034347851 and 09053130518, or email us at cfmclimited@gmail.com

In fact, we thank you for reading through. You can bookmark this page for updates. And again, this is the time to think of helping a brother, sister, or friend. Let them know what we can do for them. You can do this by sharing this post. Like us on our Facebook for updates. Thanks for reading through NIRSAL AGSMEIS Financial Model for Rice Mill Business Plan.

Deacon Anekperechi Nworgu, a seasoned economist who transitioned into a chartered accountant, auditor, tax practitioner, and business consultant, brings with him a wealth of industry expertise spanning over 37 years.