The Importance of Cost Accountants in Driving Profitability and Financial Efficiency. Cost accountants play a crucial role in any business, providing invaluable insights into financial performance and profitability. In today’s highly competitive business environment, it’s more important than ever for companies to maximize their financial efficiency and optimize their operations for profitability. This is where cost accountants come in – they are experts in analyzing financial data, identifying areas for improvement, and implementing effective cost-saving strategies. By working closely with management and other key stakeholders, cost accountants can help businesses achieve sustainable growth and long-term success.

This post will explore the importance of cost accountants in businesses and how they can help drive profitability and financial efficiency. Therefore, understanding this post will help your business. Unlocking Business Growth: The Importance of Cost Accountants in Driving Profitability and Financial Efficiency is where to start from.

Completefmc. Business Tips:

Table of Contents

Completefmc. Business Tips are very comprehensive. Now, do you need professional Consultations for your business incorporation and annual returns? At completefmc Ltd, our consultancy services cover your business development challenges. We start it off with developing lucrative business ideas and planning, business incorporation, and other start-up issues. You just have to leverage the untapped potential of your business right early. So, contact cfmclimited@gmail.com, or +234 8034347851 today! The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

This particular post has other related posts which can help you.

- Who is a bookkeeper?

- SCUML Certification: This is how to go about it

- Accounting Cycles for business start-ups

- Benefits of Cost Accounting for your business

- Jobs in the Accounting Profession

- Basic Accenting for your business

- GAAP for small business

- Statement of Affairs for CAC Annual Returns

Unlocking Business Growth: The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

Control over costs:

Cost accounting helps you control your business cost in the following ways.

- Identifying and analyzing costs

- Monitoring and controlling expenses

Identifying and analyzing costs by Cost Accountants:

Cost accountants are responsible for identifying and analyzing costs within a business or organization. This process is known as cost accounting. And it involves tracking and recording all of the expenses associated with producing goods or providing services.

To identify costs, cost accountants typically use various methods, such as:

- Direct Costing: Identifying and measuring the direct costs of producing goods or services. These include materials, labor, and other expenses that are directly associated with production.

- Indirect Costing: Identifying and measuring the indirect costs that are not directly associated with production, such as rent, utilities, and administrative expenses. The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

- Activity-Based Costing: Identifying and measuring costs based on the activities that are involved in producing goods or providing services. This method involves breaking down the production process into its individual activities. And then identifying the costs associated with each activity.

Once costs have been identified, cost accountants analyze them to determine how they are affecting the profitability of the business. This analysis may involve comparing actual costs to budgeted costs, calculating variances, and identifying areas where costs can be reduced.

Overall, the goal of cost accounting is to provide management with accurate and timely information about the costs associated with producing goods. Or providing services, so that they can make informed decisions about pricing, production, and other important business activities.

Unlocking Business Growth: The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

Monitoring and controlling expenses by Cost Accountants:

Monitoring and controlling expenses is a critical function of cost accounting. Cost accountants play a key role in ensuring that a business or organization is operating efficiently and effectively. This is by identifying areas where expenses can be reduced and implementing strategies to control costs.

Here are some of the ways in which cost accountants monitor and control expenses:

- Budgeting: Cost accountants help to develop budgets for different departments and projects within the organization. They then monitor actual expenses against the budget and make adjustments as needed to ensure that expenses stay within the allotted amount.

- Cost Reduction Strategies: Cost accountants identify areas where expenses can be reduced. And work with management to develop and implement cost-reduction strategies. This may involve finding more cost-effective suppliers, optimizing production processes, or reducing waste.

- Variance Analysis: Cost accountants analyze the differences between actual expenses and budgeted expenses. This helps to identify areas where expenses are higher than expected and allows for corrective action to be taken. Check out Unlocking Business Growth: The Importance of Cost Accountants in Driving Profitability and Financial Efficiency. The Importance of Cost Accountants in Driving Profitability and Financial Efficiency.

- Financial Reporting: Cost accountants prepare financial reports that provide insight into the organization’s expenses. These reports help management to make informed decisions about resource allocation and identify areas where expenses can be further controlled.

- Performance Measurement: Cost accountants also play a role in measuring the performance of different departments and projects within the organization. By monitoring expenses and comparing them to key performance indicators, cost accountants can identify areas where expenses may be out of line with expected results.

Overall, monitoring and controlling expenses is a critical function of cost accounting. Cost accountants use a variety of tools and techniques to identify areas where expenses can be reduced. And help to implement strategies to control costs and improve overall profitability.

The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

Decision-making:

This is very important in understanding the importance of Cost Accountants in Businesses. Decision-making is part of the functions of Cost Accounting. We shall be looking at the following for it.

- Providing data and analysis for decision-making

- Identifying areas for cost reduction

Cost Accounting Providing data and analysis for decision-making:

Cost accounting is a branch of accounting that is concerned with the collection, analysis, and interpretation of financial and operational information. And that is to assist management in making effective business decisions. It provides data and analysis to support decision-making in areas such as pricing, product mix, production efficiency, cost control, budgeting, and capital investment. The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

Cost accounting provides detailed information about the costs of products or services, including direct costs such as materials and labor, as well as indirect costs such as overhead expenses. This information can be used to identify cost-saving opportunities, optimize pricing strategies, and improve overall profitability. That is what Unlocking Business Growth: The Importance of Cost Accountants in Driving Profitability and Financial Efficiency is all about.

Some of the key techniques used in cost accounting include job order costing, process costing, activity-based costing, and standard costing. These techniques help managers to better understand the costs associated with different products or services, and to make informed decisions about how to allocate resources and optimize production processes. The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

In summary, cost accounting plays a crucial role in providing data and analysis for decision-making in a wide range of business settings. Providing managers with accurate and timely information about costs. It enables them to make more informed decisions that can lead to improved performance, increased profitability, and long-term success.

Cost Accounting in Identifying Areas for cost reduction:

Cost accounting is an essential tool for identifying areas for cost reduction within a business. By analyzing the various costs incurred in the production or delivery of goods and services, cost accounting can help identify inefficiencies, waste, and opportunities for improvement.

Here are some ways in which cost accounting can help identify areas for cost reduction:

- Identify cost drivers: Cost accounting can help identify the factors that contribute to the costs of producing goods or services. By identifying the key cost drivers, managers can focus on reducing costs in these areas to achieve the greatest impact.

- Analyze overhead costs: Cost accounting can help analyze overhead costs such as rent, utilities, and salaries. By identifying the costs associated with each activity, managers can determine whether they are necessary or if there are more cost-effective alternatives.

- Evaluate production processes: Cost accounting can help evaluate the efficiency of production processes, including the use of labor and materials. By identifying inefficiencies and bottlenecks, managers can make changes to improve productivity and reduce costs. The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

- Review pricing strategies: Cost accounting can help determine whether pricing strategies are generating sufficient revenue to cover costs. By analyzing the cost of producing goods or services, managers can determine whether adjustments need to be made to pricing strategies.

- Evaluate product mix: Cost accounting can help evaluate the profitability of different product lines. By analyzing the costs associated with each product line, managers can determine which products are most profitable and which may need to be discontinued.

In conclusion, cost accounting provides a comprehensive understanding of the costs of producing goods or services, which can help identify areas for cost reduction. By analyzing costs, managers can make informed decisions about how to allocate resources, improve efficiency, and increase profitability.

Unlocking Business Growth: The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

Product Pricing:

How do you know how much to charge for your products or services? Cost accounting will help you if you understand the following;

- Determining accurate product costs

- Setting appropriate prices for products

Cost Accounting Determining accurate product costs:

Determining accurate product costs is an important aspect of cost accounting. It helps businesses to make informed decisions regarding pricing, production, and profitability. Here are some steps that businesses can take to ensure accurate product costing:

- Identify direct costs. Direct costs are expenses that can be directly traced to the production of a product, such as raw materials, direct labor, and direct overhead. By identifying and tracking these costs, businesses can determine the direct cost of each unit of product.

- Allocate indirect costs. Indirect costs, such as overhead expenses (rent, utilities, etc.), cannot be directly attributed to the production of a single unit of product. However, they still contribute to the overall cost of production. To allocate these costs to each unit of product, businesses can use a cost allocation method, such as activity-based costing or absorption costing. The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

- Determine the cost of goods sold. Once the direct and indirect costs have been determined, businesses can calculate the cost of goods sold (COGS) for each unit of product. COGS includes all of the direct and indirect costs associated with the production of a product.

- Review and update product costs regularly: Product costs can change over time due to fluctuations in raw material prices, labor costs, or overhead expenses. Businesses should regularly review and update their product costs to ensure that they remain accurate and relevant.

By following these steps, businesses can determine accurate product costs, which can help them make informed decisions about pricing, production, and profitability.

Cost Accounting Setting appropriate prices for products:

Setting appropriate prices for products is crucial for businesses to ensure profitability and competitiveness in the market. Here are some steps that businesses can take to set appropriate prices for their products:

- Determine the total cost of production: As mentioned earlier, accurately determining the cost of production is crucial to setting the right price for a product. Businesses need to factor in all the direct and indirect costs associated with producing a product.

- Consider the target market: Understanding the target market’s purchasing behavior, preferences, and willingness to pay can help businesses determine a price point that is both attractive to the target market and profitable for the business.

- Analyze competition: Knowing the prices of competitors’ products in the same market can help businesses determine how to position their products and what price point to set. This analysis can also help businesses differentiate their product based on unique features and benefits. The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

- Determine the desired profit margin: Businesses need to determine their desired profit margin based on their financial goals and objectives. The profit margin should be factored into the price calculation to ensure that the price covers all costs and allows for a reasonable profit.

- Test and adjust the price: After setting the initial price, businesses should monitor sales and customer feedback and make adjustments as necessary to ensure that the price is effective in achieving the desired financial objectives.

By following these steps, businesses can set appropriate prices for their products that not only attract customers but also ensure profitability and competitiveness in the market.

Unlocking Business Growth: The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

Budgeting and forecasting:

This is another important factor in understanding the importance of Cost Accountants in Businesses. Budgeting and forecasting are part of the functions of Cost Accounting. We shall be looking at the following for it.

- Developing budgets and financial plans

- Providing financial forecasts and projections

Cost Accounting Developing budgets and financial plans:

Developing budgets and financial plans is an essential part of cost accounting. It involves estimating the amount of money required to carry out various business operations and making a plan to ensure that sufficient funds are available to meet these requirements. Here are some steps involved in developing budgets and financial plans:

- Analyzing historical financial data: This involves reviewing financial data from previous years to identify patterns and trends in business operations, sales, expenses, and profits.

- Identifying future financial goals: This involves determining the financial objectives of the business, such as increasing revenue, reducing costs, or increasing profits. The Importance of Cost Accountants in Driving Profitability and Financial Efficiency.

- Estimating future costs: This involves estimating the costs associated with various business operations, such as manufacturing, marketing, distribution, and administrative expenses.

- Preparing a budget: Based on the analysis of historical data and future financial goals, a budget is prepared that outlines the estimated income and expenses for the coming period.

- Monitoring and controlling financial performance: Once the budget is prepared, it is important to monitor and control financial performance by comparing actual results with the budget and making adjustments as necessary.

- Forecasting: It is also important to regularly update financial plans and forecasts to ensure that they remain relevant and accurate. The Importance of Cost Accountants in Driving Profitability and Financial Efficiency.

Overall, developing budgets and financial plans is an ongoing process that requires careful analysis, planning, and monitoring to ensure that the business has the financial resources it needs to achieve its goals.

Unlocking Business Growth: The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

Cost Accounting Providing financial forecasts and projections:

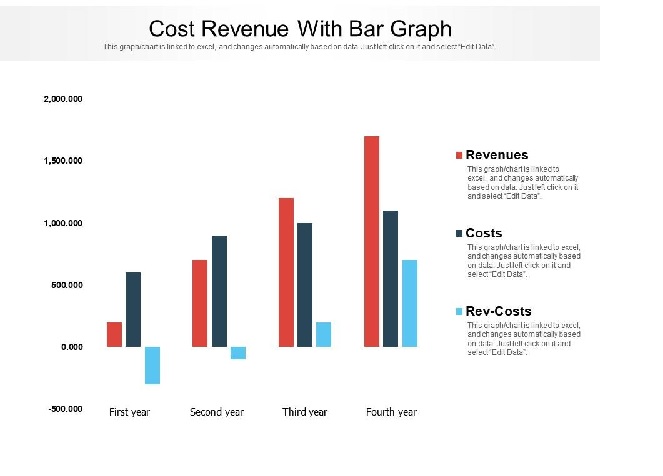

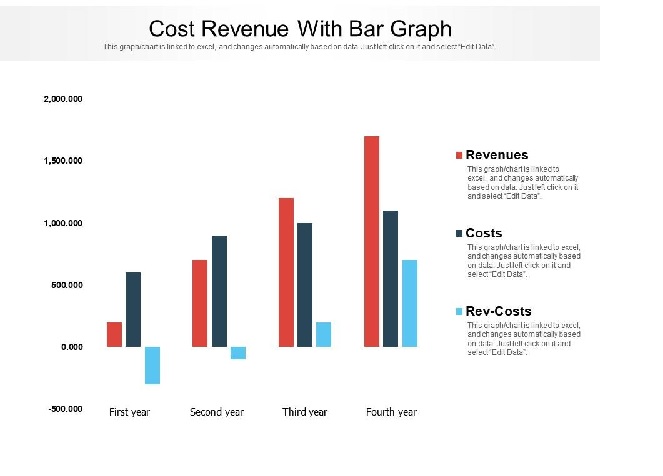

Financial forecasts and projections are important tools for cost accounting, as they help businesses to anticipate future financial performance and plan accordingly. Here are some steps involved in providing financial forecasts and projections:

- Gather relevant data: This involves collecting data on historical financial performance, current market trends, and any other relevant factors that could impact the business’s financial performance in the future. The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

- Analyze the data: This involves using various analytical tools and techniques to identify patterns, trends, and relationships in the data that can help to inform financial forecasts and projections.

- Develop a financial model: Based on the analysis of the data, a financial model is developed that includes assumptions and inputs related to various financial and operational factors that are expected to impact the business’s financial performance in the future.

Furthermore, The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

- Prepare financial forecasts and projections: Using the financial model, financial forecasts and projections are prepared that estimate the business’s future income, expenses, and profits.

- Monitor and adjust the forecasts and projections: Financial forecasts and projections are not set in stone, and it is important to regularly monitor actual financial performance and adjust the forecasts and projections as necessary based on new information or changing market conditions. The Importance of Cost Accountants in Driving Profitability and Financial Efficiency.

- Communicate the forecasts and projections: Financial forecasts and projections are used by various stakeholders, including management, investors, lenders, and other interested parties, so it is important to effectively communicate the forecasts and projections to these audiences in a clear and concise manner.

Overall, providing financial forecasts and projections is an important part of cost accounting, as it helps businesses to anticipate future financial performance and plan accordingly. However, it is important to recognize that financial forecasts and projections are based on assumptions and are not guarantees of future performance, so they should be used in conjunction with other information and analysis to make informed business decisions.

Unlocking Business Growth: The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

Compliance with regulations:

This is a very silent function of cost accounting. Only very few of us know that it plays a very significant role in complying with industry or business regulations. So, we shall be considering only two factors here to buttress this point.

- Ensuring compliance with tax laws and regulations

- Complying with accounting standards and regulations

Cost Accounting in Ensuring Compliance with tax laws and Regulations:

Cost accounting plays a crucial role in ensuring compliance with tax laws and regulations. By tracking and analyzing costs, companies can accurately calculate their tax liability and ensure they are in compliance with tax laws and regulations.

Here are some ways in which cost accounting can help ensure compliance with tax laws and regulations:

- Accurate Calculation of Tax Liability: Cost accounting helps companies accurately calculate their tax liability by tracking all expenses and ensuring they are properly allocated to the correct cost center. This ensures that companies are not underpaying or overpaying their taxes. The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

- Tracking Deductible Expenses: Cost accounting helps companies identify deductible expenses and properly allocate them to the appropriate cost center. This ensures that companies are taking advantage of all tax deductions available to them.

- Compliance with Tax Laws and Regulations: Cost accounting helps companies stay in compliance with tax laws and regulations by ensuring that all tax payments and filings are accurate and timely.

- Preparation for Audits: Cost accounting helps companies prepare for tax audits by providing a clear and accurate record of all expenses and transactions.

In summary, cost accounting plays a critical role in ensuring compliance with tax laws and regulations. By accurately tracking and analyzing costs, companies can calculate their tax liability, identify deductible expenses, stay in compliance with tax laws and regulations, and prepare for tax audits.

Unlocking Business Growth: The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

Cost Accounting in Complying with accounting standards and Regulations:

Cost accounting plays a vital role in complying with accounting standards and regulations. It helps companies ensure that their financial statements accurately reflect their financial performance and comply with accounting standards and regulations.

Here are some ways in which cost accounting can help companies comply with accounting standards and regulations:

- Accurate Record Keeping: Cost accounting helps companies keep accurate records of their financial transactions. This ensures that financial statements are reliable and can be used to comply with accounting standards and regulations. The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

- Proper Allocation of Costs: Cost accounting helps companies allocate costs properly to the correct cost center. This ensures that financial statements reflect the true cost of goods sold, which is essential for complying with accounting standards and regulations.

- Cost Control: Cost accounting helps companies control costs by identifying cost overruns and inefficiencies. This helps companies comply with accounting standards and regulations by ensuring that expenses are properly accounted for and reflected in financial statements.

- Compliance with Regulatory Requirements: Cost accounting helps companies comply with regulatory requirements by ensuring that financial statements are accurate and complete. This is essential for complying with accounting standards and regulations such as GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards).

In summary, cost accounting is critical for companies to comply with accounting standards and regulations. It ensures accurate record keeping, proper allocation of costs, cost control, and compliance with regulatory requirements. By using cost accounting, companies can ensure that their financial statements are reliable and comply with accounting standards and regulations.

Unlocking Business Growth: The Importance of Cost Accountants in Driving Profitability and Financial Efficiency

Read Also:

- SCUML Certification: This is how to go about it

- Accounting Cycles for business start-ups

- Jobs in the Accounting Profession

- Basic Accenting for your business

- Tax Clearance for Contract bidding

- GAAP for small business

- SCUML APPLICATION FORM AND PROCEDURE

- NIRSAL MFB Portal Opens for Application For COVID-19 and AGSMEIS Loan

- How to obtain NSITF Current year Compliance Certificate

- NIRSAL MFB Loan portals Current procedure on how to apply for the loan

- This is how to apply for SCUML certificate in Nigeria

- SCUML DNFIS LIST

- How PENCOM certificate wins the contracts

- Verify your NSITF Number here

Final thoughts on the significance of cost accounting and the role of cost accountants in ensuring financial stability and success in businesses:

Cost accounting is a critical component of financial management for any business. It involves identifying, measuring, analyzing, and reporting the costs of various activities, products, and services within an organization. The information gathered through cost accounting can help businesses make informed decisions about pricing, budgeting, and resource allocation.

Cost accountants play a vital role in ensuring the financial stability and success of a business. They are responsible for developing and implementing cost accounting systems, analyzing financial data, and providing guidance to management. By providing accurate and timely financial information, cost accountants help businesses identify inefficiencies, reduce costs, and increase profitability. The Importance of Cost Accountants in Driving Profitability and Financial Efficiency.

In addition to traditional cost accounting methods, cost accountants are increasingly utilizing technology to streamline processes and gather data more efficiently. This allows for a more accurate and detailed analysis of costs and can help businesses make more informed decisions.

Overall, the role of cost accounting and cost accountants cannot be overstated in ensuring the financial stability and success of businesses. They provide critical financial information that is essential for making informed decisions and managing resources effectively.

Finally, bookmark, share, and contact at cfmclimited@gmail.com, or +234 8034347851 today for your business development and support services. Now, bookmark The Importance of Cost Accountants in Driving Profitability and Financial Efficiency.

Deacon Anekperechi Nworgu, a seasoned economist who transitioned into a chartered accountant, auditor, tax practitioner, and business consultant, brings with him a wealth of industry expertise spanning over 37 years.