This is an Oil Palm Mill Business Plan Template for NIRSAL Loan in Nigeria. In fact, this is also a feasibility study on palm oil production and palm kernel oil business plan template. Included here are the marketing strategy for palm oil business. As a matter of fact, this is linked to oil palm plantation project proposal. Read more about Oil Palm Mill Business Plan Template for NIRSAL Loan here.

In other words, it’s a template for analysing cost of setting up a small and medium size palm oil mill. However, emphasis here is on AGSMEIS Oil Mill loan Proposal. Added here are variables that are relevant to AGSMEIS loan interview questions. Apply for Oil Palm Mill Business Plan Template for NIRSAL Loan here.

Oil Palm Mill Business Plan Template Relevance:

Table of Contents

Furthermore, this post is very relevant for every government loan application. With regard to NIRSAL microfinance bank loans, this is very important for the Anchor Borrower scheme and another agro-produce related loans. Please, for any commercial loan application, this is template will help you the most.

PALM OIL MILL ENTERPRISE For Oil Palm Mill Business Plan Template for NIRSAL Loan

Palm Oil Mill Enterprise is a modern technologically driven oil palm processing mill in Nigeria.

A problem worth solving:

In this regard, we found out that palm oil production is a rare business Opportunity in Nigeria. This is because Nigerian which was a major palm oil producer in the 1960s has gone down to become even importers of this commodity.

Our solutions: Oil Palm Mill Business Plan Template for NIRSAL Loan

1. Automated production

2. Mass production of product

3. Reduced cost per unit of production

.4. Meeting local demand

5. Providing market for local farmers

Sales channels:

1. Farmer Cooperatives

2. Government agencies

3. Oil Dealers

4. Other organisation

5. Supermarkets – Oil Palm Mill Business Plan Template for NIRSAL Loan

Marketing activities:

Furthermore, our marketing activities are going to be based on the gorilla model. In this connection, every form of regular and non-regular strategies will be used.

Executive Summary For Oil Palm Mill Business Plan Template for NIRSAL Loan

This Business plan is for Complete Palm Oil Enterprise. It’s a three year business projection. Its aim is to appraise its performance in the next three years, it is actually a management business plan. The business plan gives details of the enterprise operations for the next three years. The highlights of the proprietors and the management team is properly x-rayed.

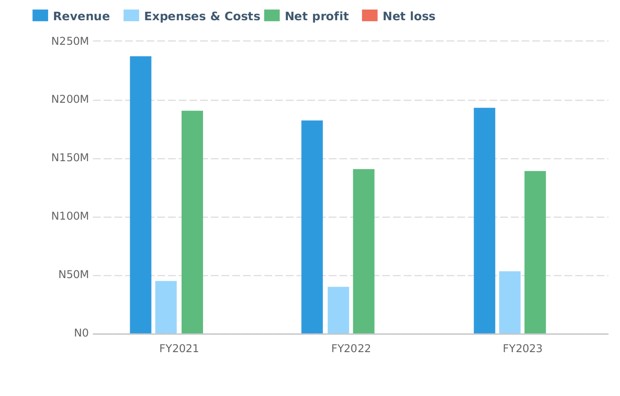

Furthermore, it also shows the financial projections of the organization within this time. As a matter of fact, it generates a total turnover of N195M each year for the three year period. This is based on our application of constant variables in this projection. In other words, it generates a flat N169M as gross profit and 85% as grass margin for the period.N106M, N104M and N102M net profit in the three years respectively. An average 54% net margin is generated. This is Oil Palm Mill Business Plan Template for NIRSAL Loan

As a matter of fact, these parameters are good for us and our investors. This business projection shows a viable business worth investing into. We therefore encourage investors, palm oil dealers, high-demand customers, and exporters to patronize us.

Company history:

Complete Palm Oil Mill Enterprise is a registered enterprise with CAC Nigeria. The owners are Mr. Emma Ogbe and John Agu. Two childhood friends grew up watching their parents processing palm oil with local and manual methods. In fact, this is the motivation for this business. We intend to bring into palm oil processing, a mechanized system that will ensure higher output and good quality red oil. This is Oil Palm Mill Business Plan Template for NIRSAL Loan

As a matter of fact, this business has been in operation for two years. That has given us the required experience to launch into a higher scale of operation. Since the inception of the operation in July there has been a great improvement in the volume of production. In fact, the estimate on this proposal is based on our current operations and anticipated growth in the next three months when the season for palm oil production peaks.

Expected return – Oil Palm Mill Business Plan Template for NIRSAL Loan

The returns on this investment is highly encouraging. The business maintains a steady revenue of N195m over the three years of our forecast. This gives rise to a steady gross profit of N167m and a gross margin of 85%. In addition, is an overall net profit of N106m across the three years of estimation. This also gives rise to a 54% net profit margin flat for the three years. These are as a result of our forecast of steady operations for the period. We have conservatively avoided overbloating our revenue generations. In this case, we have ignored every growth that occurs in this business annually.

Market:

Furthermore, The market for our goods and services are very buoyant. There is a steady market for our products. Our potential customers are members of the farmers’ cooperative societies within our operation environment. Others who demand our products are government institutions like schools, parastatals and NGOs.

In fact, the big supermarkets in the nearby cities are also our major targets. In fact, there are so many dealers who come all over the country to place orders for our products. As a matter of fact, the market is large enough to accommodate more oil palm producers.

Competition: Oil Palm Mill Business Plan Template for NIRSAL Loan

As a matter of fact, we are not worried about competition in this business. This is because there are few palm oil producers around us who use mechanized system as we do. In fact, customers need where to get the required quantity of the product. So, we have so much orders that are even delayed for supplies.

Why Us?

As enumerated above, our operations is automated and therefore produce a large quantity of output that meets customers’ demand. In addition, our marketing unit is up and doing and does not miss opportunities when they call. With such a marketing unit and a host of experienced machine operators in our payroll, customers’ need are always met. In fact, our customer base is made up of over 80% who are repeat customers.

Financing Needed: Oil Palm Mill Business Plan Template for NIRSAL Loan

Our business is financed by the proprietors. In addition to the start-up seed capital provision, they have also introduced N10m as venture capital. We had narrated how the 100% net profit generated in the company will be ploughed back in this three years of operation. In fact, this along injects not less than N106M into our activities every year for the three year in forecast.

Problems & Solutions For Oil Palm Mill Business Plan Template for NIRSAL Loan

Posing Problem for Solving:

Under global rating, Nigeria’s production for palm oil falls below many producing countries. In fact, we found out Nigeria does not even produce enough for its local need let alone for export. This is the need we see.

Our solution:

We are proffering solution to these challenge by installing a mechanised system of oil palm production in Nigeria. In fact, it’s the size that will add over 300 metric tonnes to the national output in a year. Our product is also going to be fortified with necessary vitamin and made more hygienic that other producers.

In addition, we are also tackling the distributive network which has been a big issue in the market for a long time. This is because customers travel along distance to buy these commodity from the Eastern part of the country. Our organisation has therefore decided to open three distributive outlet in Abuja, Kano they by bringing the commodity nearer to our customers.

Target Market

Our target markets are:

- Farmer Cooperative Societies

- Government agencies

- Schools.

- Palm Oil Dealers

- Super Markets

- And many others.

Competition: Oil Palm Mill Business Plan Template for NIRSAL Loan

Current alternatives

Our competitive landscape is even. We have described the fact that our operation is automated. Since there are less automated oil mills around, we do not face much competition. However, the manual producers are also a challenge considering the fact that we both source our input from the same local markets.

Notwithstanding, we have in the past six months won over 60% of the local market share. This is in both procurement of inputs and sales of processed oil. We intend to cooperate with these local farmers to boost our production in the future.

Marketing & Sales – Oil Palm Mill Business Plan Template for NIRSAL Loan

Marketing Plan

Our marketing plan is going to be very comprehensive. Therefore, the main elements of our marketing plan will include a good description of our product or service. Then, we will do an elaborate market analysis. This will enable us to define our marketing goals and objectives. So, we will look into our pricing details and advertising plan.

In other words, our marketing mix in our marketing strategy will emphasize our product, price, place, and promotion. We will not neglect social media marketing.

Company Overview for Oil Palm Mill Business Plan Template for NIRSAL Loan

Complete Palm Oil Mill is an Integrated Palm Oil Production and Processing Enterprise involved in production and processing of unadulterated hygienically prepared palm oil produce targeting Enugu state, Southeast Nigeria, the entire nation and finally for export market.

As a matter of fact, we ensure we always use the best quality inputs and ensure good agricultural practices throughout our processing process. In fact, our palm oil is certified to meet international standard and are rich in vitamin A and other mineral nutrient.

This firm is owned by three brothers. Mr John, Mark and Emmanuel. This is a partnership business.

Management team:

Our management team is;

- Chief Executive Officer (CEO).

- Chief Operating Officer (COO).

- The Chief Financial Officer (CFO)

- Chief Marketing Officer (CMO).

- Chief Operator (CO).

The Financial Analysis For Oil Palm Mill Business Plan Template for NIRSAL Loan:

In this report, we have done so many assessments of the viability, stability, and profitability of the business. Therefore, included here are the relevant income statement and balance sheet. In fact, there are other parts of this report that are not included here. You can order them directly from us.

The Projected Profit and Loss

| FY2021 | FY2022 | FY2023 | |

| Revenue | N195,600,000 | N195,600,000 | N195,600,000 |

| Direct Costs | N28,368,000 | N29,491,200 | N30,756,960 |

| Gross Margin | N167,232,000 | N166,108,800 | N164,843,040 |

| Gross Margin % | 85% | 85% | 84% |

| Operating Expenses | |||

| Salaries & Wages | N1,920,000 | N2,208,000 | N2,539,200 |

| Employee Related Expenses | N384,000 | N441,600 | N507,840 |

| Rent | N120,000 | N120,000 | N120,000 |

| Marketing | N18,000 | N18,000 | N18,000 |

| Others | N96,000 | N96,000 | N96,000 |

| Total Operating Expenses | N2,538,000 | N2,883,600 | N3,281,040 |

| Operating Income | N164,694,000 | N163,225,200 | N161,562,000 |

| Interest Incurred | |||

| Depreciation and Amortization | N1,575,000 | N1,575,000 | N1,575,000 |

| Gain or Loss from Sale of Assets | |||

| Income Taxes | N57,091,650 | N56,577,570 | N55,995,450 |

| Total Expenses | N89,572,650 | N90,527,370 | N91,608,450 |

| Net Profit | N106,027,350 | N105,072,630 | N103,991,550 |

| Net Profit / Sales | 54% | 54% | 53% |

Projected Balance Sheet – Oil Palm Mill Business Plan Template for NIRSAL Loan

| FY2021 | FY2022 | FY2023 | |

| Cash | N153,051,950 | N259,185,500 | N364,169,930 |

| Accounts Receivable | N4,075,000 | N4,075,000 | N4,075,000 |

| Inventory | |||

| Other Current Assets | |||

| Total Current Assets | N157,126,950 | N263,260,500 | N368,244,930 |

| Long-Term Assets | N17,731,000 | N17,731,000 | N17,731,000 |

| Accumulated Depreciation | (N1,575,000) | (N3,150,000) | (N4,725,000) |

| Total Long-Term Assets | N16,156,000 | N14,581,000 | N13,006,000 |

| Total Assets | N173,282,950 | N277,841,500 | N381,250,930 |

| Accounts Payable | N163,950 | N163,950 | N163,950 |

| Income Taxes Payable | N57,091,650 | N56,577,570 | N55,995,450 |

| Sales Taxes Payable | N0 | N0 | N0 |

| Short-Term Debt | |||

| Prepaid Revenue | |||

| Total Current Liabilities | N57,255,600 | N56,741,520 | N56,159,400 |

| Long-Term Debt | |||

| Long-Term Liabilities | |||

| Total Liabilities | N57,255,600 | N56,741,520 | N56,159,400 |

| Paid-In Capital | N10,000,000 | N10,000,000 | N10,000,000 |

| Retained Earnings | N0 | N106,027,350 | N211,099,980 |

| Earnings | N106,027,350 | N105,072,630 | N103,991,550 |

| Total Owner’s Equity | N116,027,350 | N221,099,980 | N325,091,530 |

| Total Liabilities & Equity | N173,282,950 | N277,841,500 | N381,250,930 |

RELATED TOPICS:

- Over 50 AGSMEIS LOAN BUSINESS PLAN TENPLATES

- OUR AGSMEIS TRAINING CENTRE

- DRY CLEANING BUSINESS PLAN FOR AGSMEIS NIRSAL LOAN

- How does AGSMEIS Loan work?

- NIRSAL AGSMEIS Financial Model for Rice Mill

- Business plan template for Agrobusiness NIRSAL bank loan

- Get more here

- Skill Acquisition BPlan Template

- NIRSAL BANK FINANCIAL MODEL FOR RICE MILL BPLAN

- Apply for AGSMEIS On-line training here

- Sample Business Consultants BPlan

- How to download the NIRSAL Model template

- What You should do to get AGSMEIS Loan

- Who is Eligible for AGSMEIS Loan

- Current AGSMEIS Loan Requirements

- Oil Palm Mill Business Plan Template for NIRSAL Loan

What about Us?

Finally, to succeed in any loan application, you must be sure your financial model is well done. This is because the investor is always looking for certain facts. In this connection, I wish to introduce ourselves to you. Complete Full Marks Consultants Limited, is the owner of this website. Therefore, as a firm of chartered accountants, we generate a standard financial report that does not fail you. This is because we have every facility necessary to do this. So, as professionals, we produce bankable reports in this respect. You may wish to contact us at +234 8034347851 or [email protected] This is Oil Palm Mill Business Plan Template for NIRSAL Loan

You can now show your support by liking, sharing, and following us to stay updated. For easy access, consider bookmarking this page. Thank you for your support – Oil Palm Mill Business Plan Template for NIRSAL Loan

Deacon Anekperechi Nworgu, a seasoned economist who transitioned into a chartered accountant, auditor, tax practitioner, and business consultant, brings with him a wealth of industry expertise spanning over 37 years.